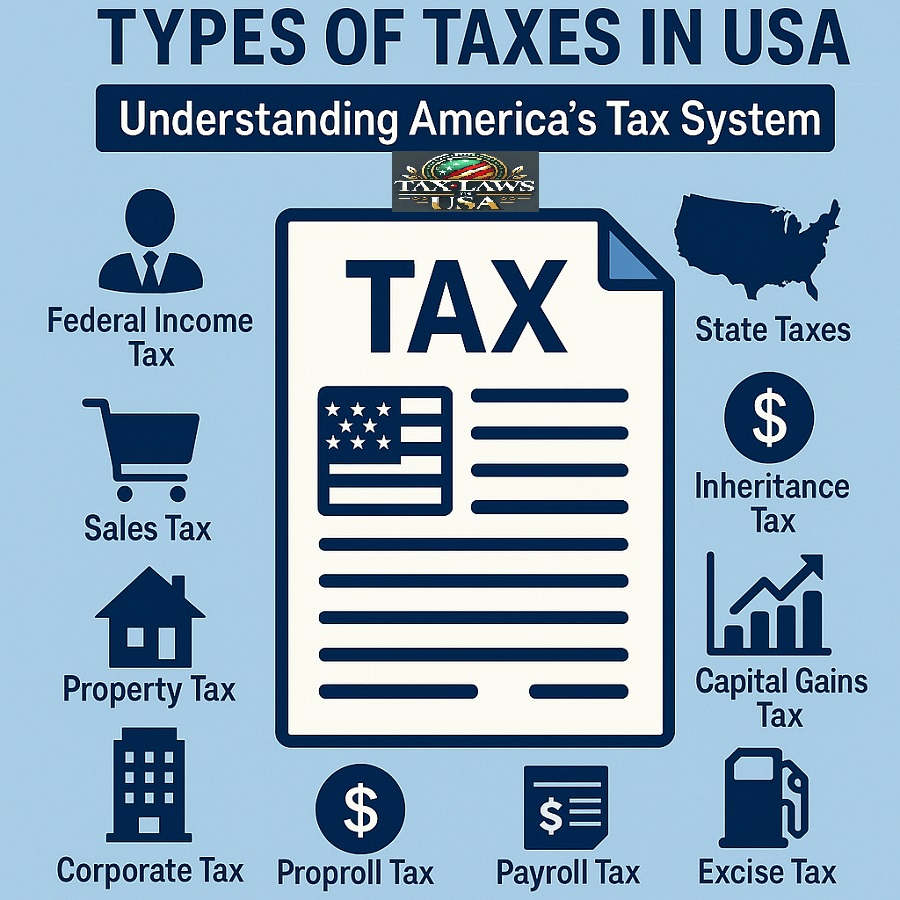

In this article we describes a comprehensive guide on Types of Taxes in USA and Understanding America’s Tax System. Tax season comes around each year, and for many Americans, it can feel like an obstacle course to navigate. Sarah from Denver recently informed me how she unknowingly paid seven different types of taxes without even realizing it: she believed taxes only came out of her paycheck until she realized she was taxed for everything from personal purchases and income earned to car purchases.

Truth be told, taxes in the USA are far more varied and complex than most people realize. From your daily cup of coffee purchase to filing an income tax return each year, various forms of taxation touch nearly every aspect of American life.

Understanding the Foundation of America’s Tax System

The U.S. has a multilayered tax system. Federal, state, and local taxes are the sources of taxes. This complicated combination finances government activities, infrastructure developments, social policies and military expenditures.

Federal taxes are collected by the Internal Revenue Service (IRS). The tax systems in state and local governments are different. There are many types of taxes that Americans might have to pay simultaneously, but their purposes are different.

Federal Income Tax: The Backbone of American Taxation

The largest source of government revenues is federal income tax. It implicates nearly every working American.

How Federal Income Tax Works

The federal tax is divided into blocks. The tax on the taxable income is as follows: up to 11, 000 taxable income is taxed at 10%. Income over $609,350 is taxed at 37%.

The state tax is pegged on the adjusted gross income. This is comprised of wages, investments, business income and any deductions or adjustments.

Assume that Mark is a software developer earning 75000 a year. He pays tax based on the marginal bracket his income is based. His first $11,000 is taxed at 10%. The following amounts are charged higher rates, like 12 percent.

Types of Income Subject to Federal Tax

Three primary sources of income that are recognized in the tax code include earned income, passive income and portfolio income. Wages or self-employment is considered as earned income. Rentals or limited partnerships represent the source of passive income. Portfolio income is obtained through stocks, bonds etc.

Earned income is subject to income and payroll tax. Capital-gain rates of some of the investment income can be preferential.

State Taxes: Varying Approaches Across America

Another significant taxes are state taxes. Their rates are very different among states. Income tax does not exist in other states. Federal rates are surpassable by others.

State Income Tax Variations

There are nine states, which do not have state income tax: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming. Such states depend on alternative sources of revenues such as the sales taxes.

Other states imposing income tax use other schemes: some of them follow federal scales, others use flat rates. California’s top rate is 13.3%. Colorado uses a flat 4.4% rate.

State Sales Tax Systems

Sales tax is regressive: everybody pays the same amount of tax. In Delaware and Oregon, the rates are at 0% and in California and Tennessee, there are over 7%.

Sales taxes are commonly imposed by the local governments at an additional level on the state rate. Some combined rates exceed 10%. As an illustration, Chicago citizens that pay a combined sales tax of 10.25%.

Property Tax: The Foundation of Local Government Funding

The local governments earn most of their income through property tax. It subsidizes schools, police, fire services and roads. Real estate and some personal property such as cars and boats are covered under property tax.

How Property Tax Calculation Works

The property taxes are equal to the assessed value x the local tax rate. The percentage is given in mills (1 mill = 1/1000). Overall, assessment techniques vary by jurisdiction; some jurisdictions review on an annual basis, others are reviewing after a few years.

There is a significant variation in the property tax rates in America. The effective rate of New Jersey residents is 2.21. Hawaii’s rate is just 0.331%.

Understanding Assessment and Appeals

The pricing of property can be inaccurate. An assessment can be challenged by its owners. Appeals typically must show evidence of similar values or showing of errors of appraisal.

Payroll Tax: Funding Social Security and Medicare

The majority of Americans have their share of taxes in payroll taxes. They are financing Social Security and Medicare which are major safety-net programs.

Social Security and Medicare Tax Breakdown

The Social Security tax rate will be 6.2 percent on income up to $160,200 in 2024. The tax is 1.45 percent and no wage cap on top of which is an additional 0.9 percent on high wage earners.

Individuals that are self-employed pay the entire Social Security and medicine taxes. The combined rate is 15.3%. The half of this amount can be deduced on their income tax filing.

Corporate Tax: Business Taxation in America

The primary type of corporate tax is C corporations. The tax is imposed on their owners through partnerships and S corporations.

In 2017, the federal corporate tax rate was reduced to 21% and used to be 35%.

State Corporate Tax Variations

States impose their rates of corporate tax. The range is between zero and over 9 percent in Iowa. There are those that utilize flat-rated, and those that utilize graduated bracket.

Tax policies are very vital in the location of businesses. Tax consideration is a factor that companies consider when making business location or expansion decisions.

Capital Gains Tax: Taxation on Investment Profits

Capital gains tax is imposed on investment, real estate, and other capital gains, as a result of the disposition of an investment, real property, or other capital gains like stocks.

Its rate varies based on the duration that you owned the instrument. Long term gains are taxed differently as compared to short term gains.

Short vs. Long-term Capital Gains.

Preferential rates of 0 %, 15⁻ 20 are paid on long-term gains, which include any gains you have held in excess of one year, and are related to your income.

When you use long-term preferential rates to counter the effect of inflation on returns, tax planning and record-keeping becomes more complicated.

Excise Tax: Hidden Taxes on Specific Goods

Excise tax is imposed on certain goods and services and it is generally absorbed by the price of the goods and services. Typical ones are gasoline, alcohol, tobacco and luxury goods.

Federal Excise Tax Examples

The federal gasoline tax stands at 18.4-cents per gallon; diesel at 24.4-cents. Federal tax is one dollar one penny per pack of cigarettes and states may impose additional excise tax that may be up to four dollars.

These taxes have two functions to make income and deter the consumption of products that are harmful to the health or the environment.

Inheritance Tax and Estate Tax: Wealth Transfer Taxation

Despite the large exemptions, the estate and inheritance taxes have notable influence on the generation to generation transfer of wealth.

Federal Estate Tax

Other examples of taxes that local governments collect in addition to property taxes are local income taxes, business license fees, hotel occupancy taxes, and some others.

Local Taxes: Municipal Revenue Sources

Most cities and counties have their own sources of income tax which is on top of the federal and state taxation. By way of example, residents of New York City will pay a city income tax of up to 3.876 percent.

Municipal Income Taxes

In the U.S. tax system, progressive aspects, such as income tax, are combined with regressive aspects, such as sales tax. This mixture generates a complex total burden which depends on income.

Understanding Tax Rates in the USA: Progressive vs. Regressive Systems

Progressive taxation means that higher income earners will have to give a larger portion of the revenue. Critics say this can drag down economic growth and investment and the complexity of the system encourages tax evasion.

Progressive Tax System Benefits and Drawbacks

The tax structure in the U.S. is a combination of the progressive tax (such as the income tax) and the regressive tax (such as the sales tax). The burden that results is complicated and depends on income level.

How the IRS and Tax Collection Work

In the U.S. the main tax-collector is the IRS. It also processes in excess of 150 million individual tax returns each year and also trains taxpayers, administers tax law and executes tax policy.

Tax Compliance and Enforcement

The IRS ensures adherence in a number of ways. Even when there are low audit rates, complex computer systems are used to identify discrepancies.

Tax Filing in the US: Navigating the Process

Deadlines, filing statuses and forms required can make even simple tax returns complicated. The process normally begins in January as employers/financial institutions send tax documents.

Filing Status Options

Depending on your filing status, the deductions and tax liability are highly dependent. These are single, married filing jointly and married filing separately. There are tax brackets and standard deductions of each status.

Economic Impact of Taxes on American Society

Taxes do not just increase revenue. They influence social policy, distribution of wealth and economic behavior. The tax policy influences the manner in which businesses will invest and the manner in which the people will spend.

Government Revenue Sources and Allocation

The bulk of federal revenues is taken by income taxes (approximately 50 per cent) and payroll taxes (35 per cent). Corporate taxes contribute approximately 10-percent of the total revenue.

Tax Reforms and Future Considerations

New taxation regulations have altered the corporate rates, individual brackets, credits, and deductions.

Emerging Tax Policy Discussions

Discussions on the tax policy include wealth taxes, tax on digital services, carbon taxes and structural changes. Such talks reflect changing economic times.

Practical Tips for Managing Multiple Tax Obligations

Learning the different taxes in the U.S. enable the citizens to make wiser financial choices, as well as maximize benefits within the law.

Record-Keeping and Organization

The digital tools have the potential to make record keeping easier. Have separate folders of income, deductions and investments. This organization simplifies the audits and maintains documents.

Working with Tax Professionals

The American taxation system is a complicated one, particularly where there are other sources of income or high investment. A professional would assist you in keeping up to date with the regulations and also discover tax-saving opportunities.

Conclusion: Mastering America’s Complex Tax Landscape

Taxes in the U.S. are complicated, but can be understood. All the taxes, federal, state, and local are useful and contribute to the national fiscal system. Awareness of your obligations enables more improved financial decisions, compliance and maximum optimization of taxes. By doing some planning and having some knowledge, you are able to move through the system without any complications.

Sarah hired a tax consultant to maximize her deductions and optimize her business after being informed of all the various taxes that she was paying. Her financial situation was better even though her tax burden did not vanish due to the fact that she planned and understood the situation better.

The trick is to have knowledge about the working of taxes and plan accordingly. The important thing is to know how the taxes operate, and to plan with this in mind. To get further information regarding and other laws, visit our site: Tax Laws in the USA.

Frequently Asked Questions

A: What are the number of types of taxes in the USA?

The United States tax system may be complicated. You should rely on the help of the professional, in case you have several sources of income, your business, or you make huge investments. Tax professional is informed about the recent rules and can choose the opportunities of optimization.

Federal vs. state tax What is the difference between federal and state income tax?

In the U.S. there are over a dozen major types of taxes which include federal income tax, state sales taxes, property taxes, payroll taxes, payroll excise tax as well as local sales taxes. Precise information is according to the place of residence and conditions.

Are not all Americans taxed in the same ways?

There are states that have no income taxes whatsoever and those with higher rates than federal rates.

What is the progressive tax system of the USA?

There is no equal combination of tax paid by all Americans. It is based on the sources of income, location, property ownership and business operations. All people pay some sort of tax, although the combination is very diverse.

How much are businesses paying in taxes as opposed to individuals?

Businesses are taxed corporate income tax, employee payroll taxes, property tax, sales taxes and other licensing fees based on business structure, location and operations. These are usually harder than the obligations of individuals.

Who is the collector of various kinds of taxes in America?

Federal taxes are collected by the IRS. State taxes are collected by the state revenue departments. Local property and local fees are collected by the local governments. Other taxes require the collaboration of several agencies.

How are the tax rates in the USA set?

Each level has a legislative process in determining the tax rates. Federal rates are set by the Congress, state rates are set by state legislatures and local rates are set by city councils or county commissioners.

Why then do we have so many varieties of different types of taxes?

Each tax serves a function. General government activities are supported by income tax, Social security and Medicare are supported by payroll taxes, local services are supported by property tax, detrimental behavior is discouraged by excise taxes and revenue is raised.